Professor Andreas Ittner, Head of BCCM at Mittweida University of Applied Sciences, commented: “Etherisc has an inspirational vision to make insurance fair and accessible through a decentralized open-source insurance protocol and we are excited to bring our expertise to bear in the development of a joint product.

“Together with Etherisc, we are exploring methods to incorporate the latest technological developments and harness the potential of blockchain technology to create meaningful insurance solutions for the benefit of all consumers.”

The Etherisc / Mittweide project

The project – funded by the German Federal Ministry of Education and Research (under grant number 03WIR1316A) – aims to provide refined alternatives to traditional insurance policies. It will seek to leverage:

- decentralised autonomous organisations (DAOs)

- artificial intelligence (AI)

- machine learning (ML).

The objective is to streamline and automate the process of insurance assessment and payment. It hopes to deliver an innovative system which can provide disintermediated and sustainable risk protection.

To do this, this Community Supported Insurance project aims to create a fair and sustainable model that:

- reduces premiums

- distributes profits regionally for charitable purposes.

Blockchain technology

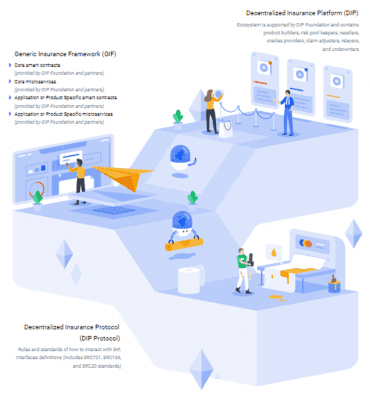

Etherisc and BCCM are collaborating on an initial proof-of-concept and pilot test. They will follow this with the development of a final prototype for a fully-fledged decentralised insurance solution. This final prototype will incorporate technologies and frameworks – such as DAOs, AI and ML – and use these tools to:

- reduce admin costs

- enable scalability for products

- provide transparency for consumers.

By using blockchain technology the Etherisc and the BCCM seek to:

- ensure both transparency and fraud protection

- enable a scalable solution that exists independent of national borders.

End-customers wishing to exploit the solution will be able to participate in its development as part of the community ethos of the project. This matters because it should shape and determine the essential features of the end result.

Commenting on the announcement, Christoph Mussenbrock, Co-founder, Protocol and Architecture at Etherisc: “We’re excited to be working with some of the brightest minds in the academic blockchain space. Traditional insurance models are characterized by cumbersome claims and payout processes, low levels of transparency, conflicts of interest, and low payout amounts.

“Through this enterprise and academic partnership, we seek to overcome these challenges through the development of an entirely new blockchain insurance platform. This harbours immense potential for consumers in the region and beyond to benefit from truly innovative insurance products and policies.”

Enterprise Times: what does this mean

For Etherisc and the BCCM, the use of a DAO brings direct customer participation in key product design and subsequent control decisions. In parallel, the project includes an AI component which it hopes will determine the risk of a claim occurring. The intended results should result in better-designed policies and faster payout processes.

DAO’s have not enjoyed particular popularity (not least after the ‘DAO Hack’). Whether Etherisc and the BCCM can satisfy their – demanding – objectives when combining DAO and AI and ML will be interesting to follow. If they do, insurance using blockchain may undergo a significant revolution.