Blockchain implements ‘distributed ledger’. The Interledger Protocol (ILP) enables different ‘ledgers’ to interoperate. At one level they both solve the issue of multiple ledgers. Yet they do this in very different ways, ones which could complement but might conflict.

In this brief analysis ET examines each. It then tries to draw a conclusion which is of practical sense.

Blockchain

“The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.” (Don & Alex Tapscott, authors of the ‘Blockchain Revolution’ (2016)).

The first widespread implementation of the blockchain concept came from a mythical person (or group) going by the name of ‘Satoshi Nakamoto‘. Nakamoto invented Bitcoin. Blockchain technology provides the underpinning of Bitcoin. It records transfers of Bitcoins on an immutable ledger that is shared and transparent to all who can process it. Ledger entries update via a complex process of consensus.

Since the Bitcoin inception of blockchain the latter has evolved into something much bigger for business. By enabling distributed, unalterable digital information, blockchain technology envisions the backbone of a new type of ledger. Information on a blockchain exists as a shared — and continually reconciled — ‘networked database’ which isn’t stored in any single location. This means the records it keeps are truly public and verifiable. In theory, because no centralized version of this networked database exists, it is that much harder for a hacker to corrupt.

Or, as William Mougayar (venture advisor, entrepreneur and blockchain strategist), has put it: “The traditional way of sharing documents with collaboration is to send a Microsoft Word document to another recipient, and ask them to make revisions to it. The problem with that scenario is that you need to wait until receiving a return copy before you can see or make other changes because you are locked out of editing it until the other person is done with it.

“That’s how databases work today. Two owners can’t be messing with the same record at once.That’s how banks maintain money balances and transfers; they briefly lock access (or decrease the balance) while they make a transfer, then update the other side, then re-open access (or update again).With Google Docs (or Google Sheets), both parties have access to the same document at the same time, and the single version of that document is always visible to both of them. It is like a shared ledger, but it is a shared document. The distributed part comes into play when sharing involves a number of people.

“Imagine the number of legal documents that should be used that way. Instead of passing them to each other, losing track of versions, and not being in sync with the other version, why can’t ‘all’ business documents become shared instead of transferred back and forth? So many types of legal contracts would be ideal for that kind of workflow.You don’t need a blockchain to share documents, but the shared documents analogy is a powerful one.”

Blockchain technology has built-in robustness. By storing blocks of information that are identical across its network, the blockchain possesses five significant qualities:

- propagation (many copies)

- permanence (unlaterable transactions)

- programmability (smart contracts)

- no single entity controls it (the blockchain)

- there is no single point of failure.

The importance of ledgers

Traditionally, ledgers are the basis of recording accounting information. As Wikipedia puts it “A ledger is the principal book or computer file for recording and totaling economic transactions measured in terms of a monetary unit of account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.”

Pacioli’s double entry bookkeeping has dominated financial record keeping for centuries. In consequence, almost all businesses (though not necessarily government) possess such a ledger. These are inherent parts of how businesses operate.

Arguably, the zenith of double entry ledger bookeeping arrived with modern ERP systems – from the likes of SAP, Oracle, NetSuite and a host of others. These provide accounting through automation of the double entry system – within each enterprise.

Herein lies the rub. The double entries are held and governed within an enterprise, not between enterprises. Indeed, when two businesses interact – one (say) buys from the other, the seller will record the sale with a debit and a credit. Similarly, for the buyer, there will be a debit and a credit. In other words, to embrace the whole transaction chain there is a need for at least four book entries (the quadruplicative effect). Furthermore, each entry pair is invisible to the other participant.

This, in part, explains the attraction of a blockchain approach. It is what the ICAEW has called “a kind of universal entry bookkeeping“. In theory a blockchain which implements universal entry bookkeeping could supplant double entry bookkeeping – and be more useful because of the transparency and immutability inherent in blockchain.

Enter ILP

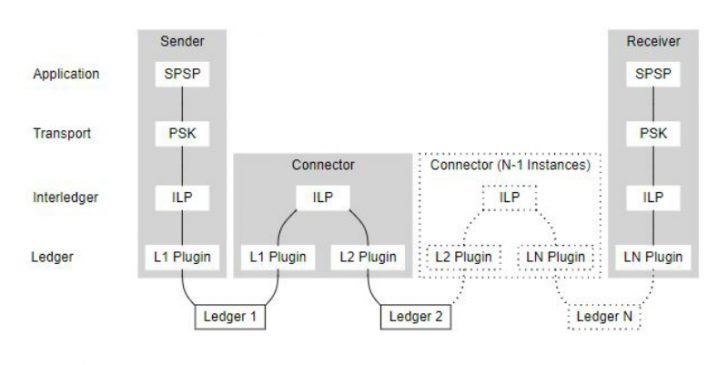

ILP is an open protocol for sending payments across different ledgers. Like routers on the Internet, connectors route packets of money across independent payment networks. An open architecture and minimal protocol enable interoperability for any value transfer system. Furthermore, ILP has no ties to any one company, blockchain or currency.

In the original paper which described the ILP, Ripple’s Thomas and Schwarz posited: “Digital payment systems use ledgers to track accounts and balances and to enable local transfers between their users. Today, there are few connectors facilitating payments between these ledgers and there are high barriers to entry for creating new connections. Connectors are not standardized and they must be trusted not to steal the sender’s money.

“In this paper, we present a protocol for interledger payments that enables anyone with accounts on two ledgers to create connections between them. It uses ledger provided escrow—conditional locking of funds—to allow secure payments through untrusted connectors. Any ledger can integrate this protocol simply by enabling escrowed transfers. Unlike previous approaches, our protocol does not rely on any global coordinating system or ledger for processing payments — centralized or decentralized.

“Unlike previous approaches, this protocol requires no global coordinating system or blockchain. Transfers are escrowed in series from the sender to the recipient and executed using one of two modes. In the Atomic mode, transfers are coordinated using an ad-hoc group of notaries selected by the participants. In the Universal mode, there is no external coordination. Instead, bounded execution windows, participant incentives and a “reverse” execution order enable secure payments between parties without shared trust in any system or institution.”

It is this last paragraph which reveal much. Not only does ILP not depend on blockchain technology, though it can exploit blockchain distributed ledgers if so wished, but it can operate independent of blockchains.

Blockchain is not necessarily yet the right answer now

Put another way, the ILP attracts because it offers a digital mechanism, based on escrow, for existing ledgers to interwork. Exploiting something which exists is almost always preferable for businesses than taking leaps into the unknown. Intellectually, blockchain is maturing fast. In implementation terms it is nowhere near as advanced as proponents wish.

Against this some will argue that the real attraction of blockchain is its potential to eliminate ‘middleman’ – banks, agents, transfer agents and the like. This is a fair point. Except that there is nothing inherent in ILP which prevents the same occurring. Enterprise A interworks with Enterprise B. Indeed, as the diagram below indicates, multi-ledger interactions are quite possible.

In addition, blockchain technology has barely entered the proof of concept stage. For most enterprises much has yet to resolve. Issues like performance, privacy and governance remain open.

What does this mean

To choose between ignoring or investigating blockchain is straightforward. There is too much happening, for enterprises, to wave interest in blockchain away. To do so risks being left behind.

That said, choosing between blockchain and ILP is much harder, especially in an environment involving monetary recording of value (ledgers). The blockchain case is still in the course of evolution. In contrast the prime building blocks for ILP already exist.

A bifurcation could be in prospect. Non-monetary ledgers, like for food quality tracing for example, can adopt blockchain and further its evolution. In contrast,enterprises might yet prefer to adopt an ILP-led approach and move this onto blockchain technology when it has improved. After all, in an interledger environment, performance, privacy and governance are much more straightforward to determine and manage.

[…] The problem Accenture claims to address is genuine. But other solutions might yet emerge (for the InterLedger Protocol – should it make any […]