Google Earth Pro (GE Pro) customers are beginning to live life without access to three layers that were increasingly popular in the US. The US Parcels Data, Daily Traffic Counts and Demographics have now disappeared creating a problem for a number of US companies.

The impact on businesses and individuals is not easy to calculate but Stewart Berry, Director of Product Management at Maptitude Mapping Software gives some examples: “The features of GE Pro were popular in the real estate industry that came to rely heavily on the searchable property data that Google Earth has now killed off. The traffic count data was widely used in retail for store placement, while the demographics were used throughout the business analysis community.”

Vendors making commercial decisions

Cutting this data is a purely commercial decision by Google. In early 2015 Google announced that it would be discontinuing its enterprise Geographical Information System (GIS) products Google Earth Enterprise and Google Maps Engine. It was also going to make it a professional GIS user product, GE Pro, free of charge.

Google is not the only vendor making commercial decisions around GIS tools. According to Berry: “Esri killed their budget Business Map product a few years ago [and] Microsoft killed Microsoft MapPoint, Street & Trip and Autoroute.”

All of this has left the professional GIS users with a very limited set of options. Commenting on the Microsoft decision Berry believes that the alternatives offered by Microsoft are: “inadequate and include inflexibility, limited features, and cost.” While there are other options Berry comments: “The Bing and Google solutions are far too expensive for most routing applications (which are almost by definition commercial in nature).”

Consumer apps impacting the business mapping market

Part of the underlying commercial problem here for the big mapping providers is the way the market has been changing over recent years. Consumer grade Sat Nav products are increasingly used by businesses for commercial usage. This has led to a steady stream of stories about lorries stuck in narrow lanes and fleet managers struggling to manage their vehicles. In addition, the free mapping products such as Google Maps and Bing Maps are often used to calculate journeys and cost.

These are not the only problems. Fleet managers are beginning to make better use of tracking devices to know where their vehicles are. They are also using real-time traffic data which is also available to drivers via their mobile devices. Much of that data comes from motoring organisations who also offer re-routing functions.

The digitisation of maps, especially for the leisure market means that users can create, save and share their maps and routes in KML which means other people can download and get routes without having to pay for them. This is an interesting market because where it was initially around walking and trekking routes it is now being used for vehicle routes with some companies actively using this to help delivery drivers get around.

Another threat to this market has been the integration between ERP and Sat Nav vendors. Recently IFS and TomTom linked up in a move that saw IFS take advantage of TomTom’s traffic and route technology for its IFS Mobile Workforce Management tool. This allows corporate users and logistics managers to do more effective route planning and reduce time spent in traffic jams.

All of this impacts the professional developer. As Berry has already pointed out, Google and Bing are providing data still but it is expensive for many developers. There are also new products such as ArcGIS Earth from Esri which has recently been launched. While it still doesn’t contain all the data sets that GE Pro originally had there are options for developers.

One of the options here for developers both those with start-ups and in-house developers is to buy into products such as ArcGIS Earth and then use government provided Open Data to provide layers on top. While this has a lot of excitement in the start-up arena, it does mean that the constant importing of updated data sets will cause a challenge for end-users. They would also have to consider the cost of entering a market that has historically been expensive to compete in.

What next for the business mapping market?

For those businesses who want a business mapping product and who do not want to do their own development, the market is shrinking. The withdrawal of Google and others from the business mapping space means that companies such as Maptitude are increasing their presence and offerings.

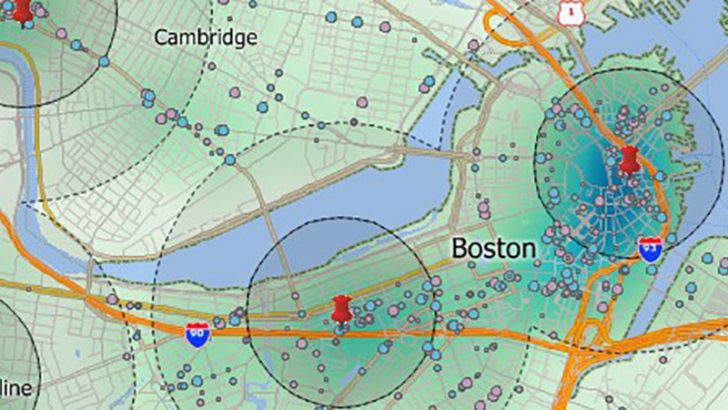

Maptitude is currently offering customers the same degree of demographics GE Pro offered and include travel speeds based on traffic data. They also plan to add in a new parcel layer soon as well as taking advantage of free parcel delivery data that is available. All of this is being done as a paid for commercial application which raises questions as to why Google and Microsoft feel this market is uncompetitive.

What will be interesting is to see how much of the GE Pro market Maptitude can win over the next year. There are clearly several markets for business mapping but the question is whether they are big enough for Maptitude to continue to support.

One solution might be to look at the agricultural market where there are a number of solutions aimed at farmers. With the growth of the direct from farm to home market it could be that Maptitude could enter that market with a delivery and routing solution. This is a fairly new market in the US but is a large growth market in Europe which would require Maptitude to rethink its international plans.

There is also an increasing demand from environmental groups for better mapping. While not a natural target for business mapping, the growth of new businesses to support a more eco-friendly society suggests there is opportunity there.

Conclusion

The business mapping space has historically been dominated by very large companies. With the big players now getting out of that market it will be interesting to see how it develops. There is still a significant demand ranging from utility companies to retailers, environmentalists to councils monitoring traffic flow.

Without this type of data it is likely that a number of companies will begin to see an increase in their costs. Logistics teams, for example, will have to move to much more expensive commercial grade Sat Nav which will force them to purchase devices and access to software applications. This may, however, be offset by deals between ERP and CRM vendors who see GIS data as a potential add-on that will appeal to retail, logistics and even manufacturing clients.

The challenge for the remaining large US incumbent Maptitude is how to grow its market and compete against the risk of new start-ups. A mix of premium and free data could be the solution as could new partnerships with the likes of Infor, Salesforce and SAP. However, they will have to act quickly to offset the risk from the likes of TomTom who have already signed up IFS and are keen to approach other enterprise software companies.