Bitcoin valuations head relentlessly up. At the start of 2017 a Bitcoin was worth a little over US$1,000. In eleven months it is almost ten times as much. What should make a virtual cryptocurrency rise so much? Are they worth it?

There is no easy answer. Two demonstrations of this are analyses coming from Bloomberg and from Aswath Damodaran. Both reveal why confusion reigns.

Asset, currency, commodity or collectible?

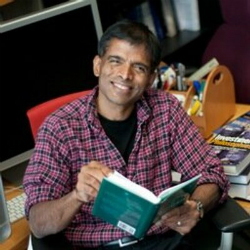

In his Musings on Markets blog, Aswath Damodaran, Profossor of Finance at the Stern School of Business, New York University, examines whether Bitcoin, and cryotocurrencies are an asset, a commodity, a currency or a collectible. This is an extraordinarily complex area:

“As I have noted with my earlier posts on crypto currencies, in general, and bitcoin, in particular, I find myself disagreeing with both its most virulent critics and its strongest proponents. Unlike Jamie Dimon, I don’t believe that bitcoin is a fraud and that people who are “stupid enough to buy it” will pay a price for that stupidity. Unlike its biggest cheerleaders, I don’t believe that crypto currencies are now or ever will be an asset class or that these currencies can change fundamental truths about risk, investing and management.

“The reason for the divide, though, is that the two sides seem to disagree fundamentally on what bitcoin is, and at the risk of raising hackles all the way around, I will argue that bitcoin is not an asset, but a currency, and as such, you cannot value it or invest in it. You can only price it and trade it.”

…

“The first step towards a serious debate on bitcoin then has to be deciding whether it is an asset, a currency, a commodity or collectible. Bitcoin is not an asset, since it does not generate cash flows standing alone for those who hold it (until you sell it). It is not a commodity, because it is not raw material that can be used in the production of something useful. The only exception that I can think off is that if it becomes a necessary component of smart contracts, it could take on the role of a commodity; that may be ethereum’s saving grace, since it has been marketed less as a currency and more as a smart contracting lubricant.

“The choice then becomes whether it is a currency or a collectible, with its supporters tilting towards the former and its detractors the latter. I argued in my last post that Bitcoin is a currency, but it is not a good one yet, insofar as it has only limited acceptance as a medium of exchange and it is too volatile to be a store of value. Looking forward, there are three possible paths that I see for Bitcoin as a currency, from best case to worst case. …”

This is an analysis worth reading with care, as are his responses to the criticisms that this piece engendered.

Bloomberg and primary central bank attitudes

Bloomberg has a useful commentary of what central banks think and worry about with Bitcoin and, to some degree, cryptocurrencies. In summary these are:

- BIS: cannot ignore

- US: privacy

- Euro area: fears another tulip bubble

- China: conditions are ‘ripe’ (to embrace the technology) yet it has cracked down

- Japan: in study mode

- U.K.: potential ‘revolution’; shows “great promise” (Mark Carney, Governor)

Bloomberg and other central bank attitudes

Other central bank attitudes, summarised, include:

- Australia: monitoring closely

- Brazil: support innovation

- Canada: asset-like (the Bank of Canada’s senior deputy governor, Carolyn Wilkins has said cryptocurrencies aren’t true forms of money)

- France: “great caution” (Bank of France Governor Francois Villeroy de Galhau)

- Germany: ‘speculative plaything’ (said Bundesbank board member Carl-Ludwig Thiele)

- India: not allowed

- Morocco: violating the law

- New Zealand: considering the future

- Netherlands: the most most daring, and most pro-blockchain (“naturally applicable” in the settlement of complex financial transactions”)

- Russia: “we don’t legalize pyramid schemes” (Governor Elvira Nabiullina)

- Scandinavia: exploring options

- South Korea: crime watch

- Turkey: important element for a cashless economy

What does it mean

With a value of around US$10K for each mined Bitcoin, there are many attitudes and opinions. These vary greatly, as the summary of central bank views illustrates – from the rigid anti-views of India and Morocco through to the more open Netherlands and even Bank of England.

Professor Damodaran’s analysis is valuable less for its conclusions and more for what it encompasses. What he demonstrates is that there are many, many uncertainties about what a cryptocurrency means. And each meaning requires a different regulatory and economic response.

Though the price of Bitcoin fascinates, much more intriguing is what lies beneath. Both Bloomberg and Damodaran illustrate how much there is still to understand.